GRAN TIERRA ENERGY (GTE)·Q4 2025 Earnings Summary

Gran Tierra Hits Record Production as Debt Restructuring Begins

January 29, 2026 · by Fintool AI Agent

Gran Tierra Energy (GTE) released its Q4 2025 operations update today, reporting record monthly production of 48,235 BOEPD in December 2025 — the highest in company history . The company also announced preliminary FY 2025 financial data and launched a debt exchange offer to extend its 2029 notes to 2031. Shares closed at $5.71 (+0.7%) but fell to $5.48 in after-hours trading (-4.0%).

Did Gran Tierra Beat Earnings?

This filing is a preliminary operations update, not a full earnings report. Final audited results are expected by March 3, 2026 . Key preliminary FY 2025 metrics:

*Values retrieved from S&P Global

The significant gross profit decline reflects non-cash impairment charges of $65-85M for Canadian assets and $30-50M for Colombian assets , plus a large inventory build of ~291,000 barrels in Ecuador that was sold in early January for ~$15M revenue .

What Drove Record Production?

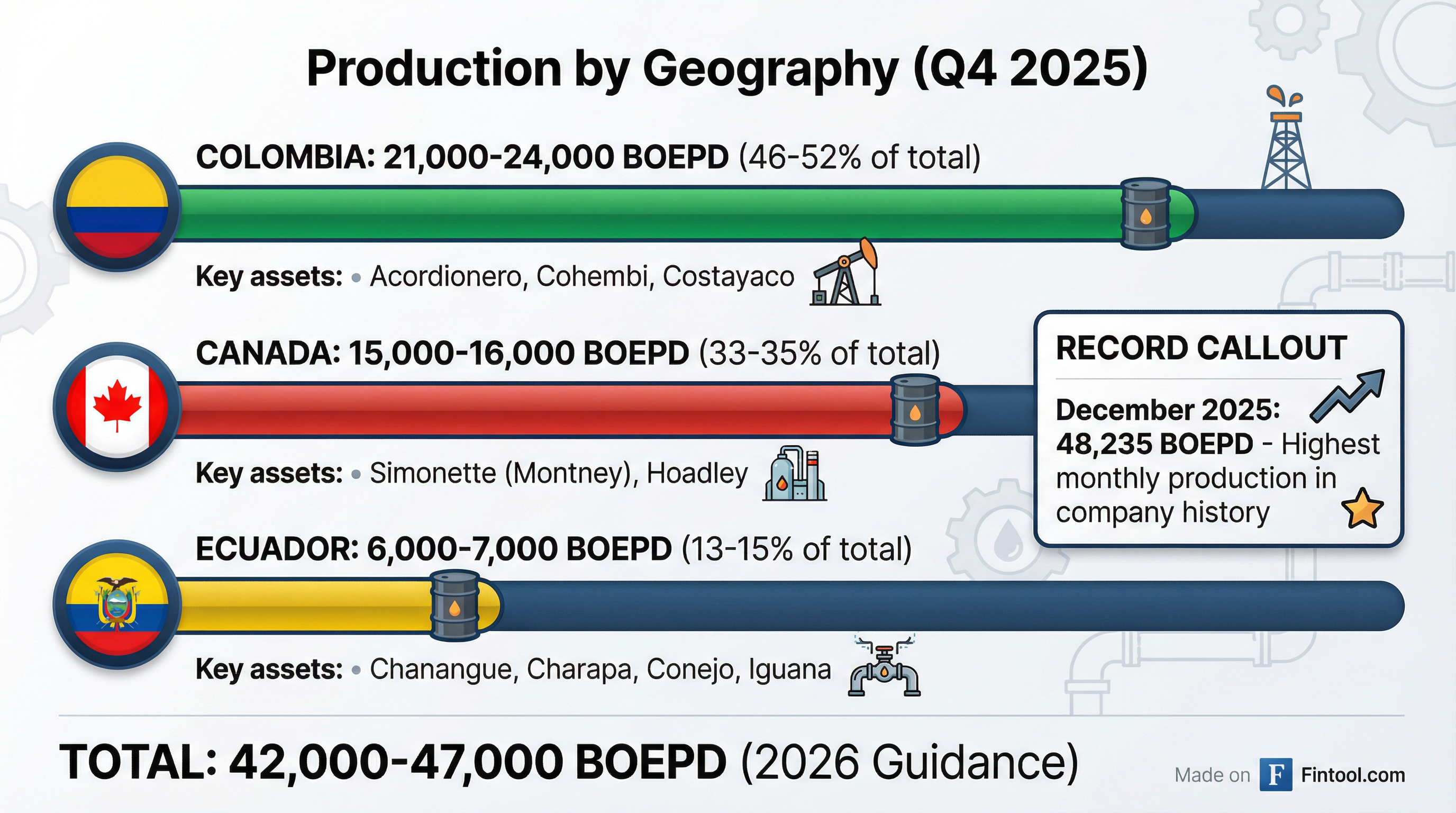

December 2025 marked a major milestone with 48,235 BOEPD — driven by strong performance across all three operating regions :

Ecuador highlights:

- Reached 10,000 BOPD production rate during Q4 2025

- Conejo discoveries delivering combined IP60 rates of ~3,238 BOPD

- All exploration commitments fulfilled

- Multiple Field Development Plans approved or submitted

Colombia highlights:

- Cohembi gross production increased to ~9,100 BOPD in Q4

- Raju-1 well successful; waterflood program showing strong response

- Capital carry commitments expected complete by mid-2026

Canada highlights:

- Lower Montney wells at Simonette meeting/exceeding type curve expectations

- 5 gross wells planned to come onstream in H2 2026

What Is the Debt Exchange Offer?

GTE announced a significant debt restructuring initiative — exchanging $716M of 9.5% Senior Notes due 2029 for new 9.5% Senior Secured Notes due 2031 :

The new notes will be secured (vs. unsecured for existing notes) and extend maturity by 2 years . GTE also secured a new oil prepayment facility to fund the cash consideration .

How Did the Stock React?

The after-hours decline suggests some investor concern about the debt exchange dynamics and the impairment charges, despite record production.

What About Reserves?

In a separate filing today, GTE reported seventh consecutive year of South American reserves growth :

Key reserve metrics:

- South America achieved >100% reserve replacement on both PDP and 2P basis

- 1P reserve life: 8 years; 2P reserve life: 15 years

- Canadian reserves reduced as some volumes reclassified to contingent resources due to lower gas prices

The NAV per share of $51.09 (2P) vs. current stock price of $5.71 highlights a significant discount to asset value — though this assumes commodity price forecasts hold and reserves are developed as planned.

What Is the 2026 Outlook?

GTE provided 2026 guidance in December 2025 :

Key priorities for 2026:

- Repay $180M debt amortization due October 2026

- Complete Suroriente carried work commitments by Q2

- Focus on free cash flow generation vs. exploration

- Target Net Debt/EBITDA below 1.5x by 2028

Key Risks and Concerns

- Debt overhang: $657M net debt vs. $202M market cap = highly leveraged balance sheet

- Exchange offer execution: If <80% participation, deal fails

- Commodity exposure: Unhedged production vulnerable to oil price declines

- Canadian asset impairments: Declining gas prices hurting NAV

- Geopolitical risk: Operations in Colombia/Ecuador carry political/operational risks

The Bottom Line

Gran Tierra delivered record production and strong South American reserve replacement — operationally, the company is executing well. However, the investment thesis hinges on:

- Successful debt exchange (Feb deadline)

- Oil prices staying above $60 Brent

- Free cash flow translating to deleveraging

With NAV/share of $51 (2P) vs. stock at $5.71, the market is pricing in significant execution and commodity risk. The debt exchange outcome in February will be the next major catalyst.

Final audited FY 2025 results expected March 3, 2026.